ZHL Research Institute: Commercial and industrial LED lighting industry is projected for 10.5% annual growth

Overview

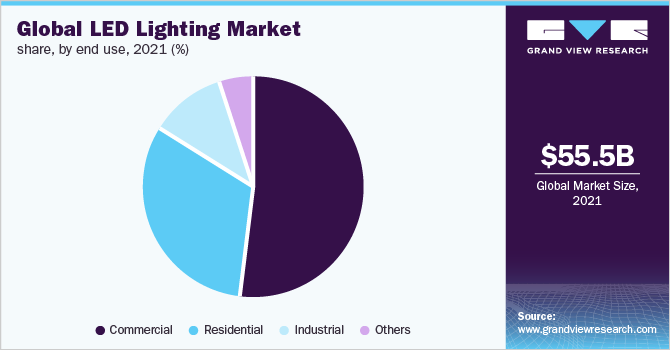

The global LED lighting market size is valued at USD 55.5 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 10.5% from 2022 to 2030. Increase in construction activities in countries developed and under development, along with stringent government regulations to decrease the adoption of inefficient lighting technologies, are the main factors that are expected to drive the market forward. LED lights offer high lumen power consuming less power, better lifespan and flicker free. In addition, LED manufacturers are focused on integrating solutions such as Wi-Fi, occupancy sensor and natural lighting, which attract consumers responsible for increasing product sales. These factors are contributing to the growth of the market.

LED lights tend to be a better solution compared to other lights like halogen, CFL and incandescent lights. LEDs operate with low power consumption, providing high illuminations, which is one of the main reasons why they are widely deployed outdoors and indoors. LEDs provide manufacturers with design flexibility along with the ability to withstand frequent changeovers. Growing awareness among consumers regarding the benefits of LED lights, along with consumers’ shift to green lighting, is expected to spur demand for LED products.

The International Electrotechnical Commission, the American National Institute of Standards and China Compulsory Certification are some of the major regulatory bodies that regulate product certification. It manufactures after obtaining the relevant certifications to sell, import, export and use the product in business and services. Governments in developed and developing countries are focused on reducing high energy consumption, they are imposing various quality related regulations that help them to ensure consumer safety, energy consumption and monitoring environmental issues. LED lights are energy saving solutions that consume less energy and provide 50,000 hours of lighting. Thus, strict government regulations related to the use of energy-intensive lighting are expected to favor the growth of the market.

Initially, halogen lights were used in overhead surgical lighting, creating discomfort for clinicians during surgery or examination. In addition, the examination room and the smaller surgical lights were made up of 50 to 100 W halogen lamps, which resulted in high energy consumption and high heat emission. Thus, the rapid technological advances in the medical device industry to replace outdated or inefficient devices/equipment and the manufacturer’s approach to integrating LEDs into surgical lighting, examination lights, phototherapy and endoscopy to improve the patient care experience are factors expected to drive target market growth

In 2020, the COVID-19 pandemic negatively impacted the global market. Strict blockages and temporary suspensions of construction sites have resulted in a decline in demand for LED lighting. However, in the second quarter of 2021, construction activities registered a growth with the introduction of new projects and redesigns, thus leading to the gradual recovery of the LED lighting market.

The commercial and industrial segment dominated the LED lighting market in 2021 and accounted for over 52.2% of the global revenue share. The commercial construction sector across the world is witnessing rapid growth and the demand for advanced lighting solutions among museum, exhibition and gallery owners for better lighting applications are factors responsible for supporting the market growth. In addition, workplace lights need to meet/comply with the standards and regulations set by the government, which is the main reason why the demand for high brightness LED lights is increasing, thus supporting the growth of the segment. For example, the US Occupational Safety and Health Administration (OSHA) requires covering light fixtures with a protective plate, installing fixtures above 7 feet in the workplace is mandatory, and mandatory coverage of wires and exposed parts of lights parts.

Regional Information

Asia Pacific accounted for a revenue share of over 42.8% in 2021 and is expected to witness high growth in the coming years. This can be attributed to rapid infrastructure development activities in developing countries, along with increased government initiatives related to energy savings, which is expected to increase demand for LED lighting. China, Japan and India are the main contributors to the market growth due to the expansion of the construction industry, along with the presence of a large number of players operating in these countries with a focus on the introduction of new products are expected factors to support the growth of the regional market.

The North America and Europe region accounted for a significant revenue share in the global market. This can be attributed to strict government regulations and initiatives related to energy efficiency. As of September 2021, in accordance with EU regulations, the minimum efficiency requirement for general service lighting has been set at 91 lm/W. Similarly, in 2017, the European Union started using an A (efficient) to G (inefficient) scale, which should help customers make more informed purchasing choices related to purchasing energy-efficient electronics.

Key Companies & Market Share Insights

Favorable business policies by the government of developing countries and backed by new venture capital firm is resulting in the emergence of new entrants in the market with an innovative solution. Likewise, major players are inclining towards acquiring major market share through strategic business acquisitions. For instance, in October 2021, Luminii, a U.S.-based global LED lighting solution provider announced the acquisition of Precision Lighting and Remote Controlled Lighting, two British lighting manufacturers. This acquisition is expected to help the company enhance its business presence and increase its customer base. Some prominent players in the global LED lighting market include:

- Acuity Brands Lighting Inc.

- Cree Lighting

- Dialight

- Digital Lumens Inc.

- Hubbell

- LSI Industries Inc.

- LumiGrow

- Panasonic Corporation

- Siteco GmbH

- Signify Holding

- Zhongheng Optoelectronics (ZHL)

- Zumtobel Group Ag

Source: